Fan Cheng With the rapid development of machine vision industry, the localization of core compon

Опубликован в:2020-07-28

Although machine vision has only developed for decades, with the rise of a new round of global scientific and technological revolution and industrial reform, the machine vision industry has ushered in rapid development. The application of machine vision has expanded from the initial field of automobile manufacturing to many fields such as consumer electronics, pharmacy, food packaging and so on.

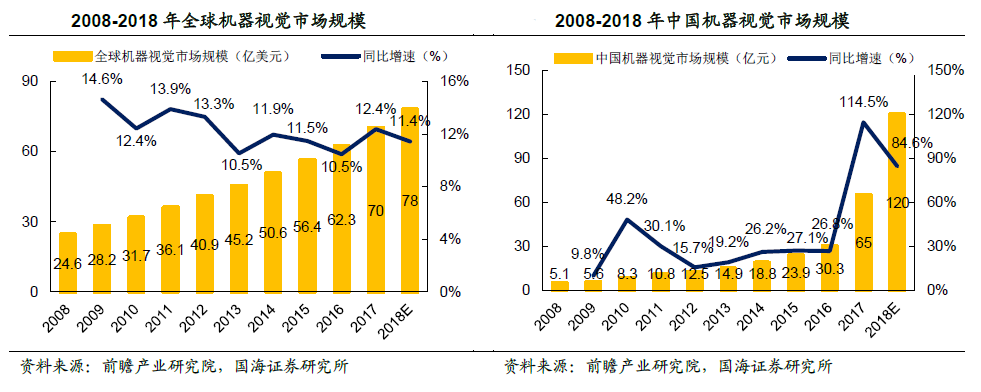

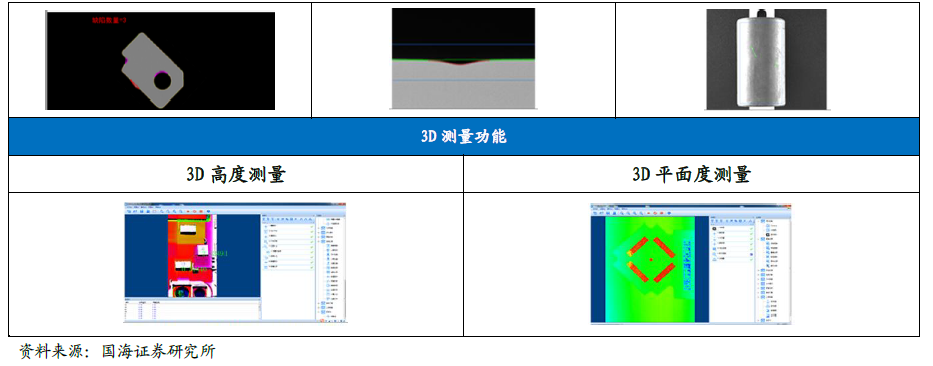

According to the prospective industry research institute, the global machine vision market grew from US $2.5 billion in 2008 to US $7 billion in 2017, with a compound annual growth rate of 12.3%. Chinas machine vision market has entered a stage of rapid development from 2008 to 2017, with a market scale of 6.5 billion yuan. The compound growth rate from 2008 to 2017 was 32.7%, significantly higher than the global level.

The high-end market of the international machine vision market is mainly occupied by American, German and Japanese brands. Cognex of the United States, National Instruments (Ni), Basler of Germany, Isra vision, KEYENCE of Japan and OMRON of Japan are international giants with technology accumulation and good customer reputation in the field of machine vision. As the two giants of the global machine vision industry, Cognex and Kearns monopolize nearly 50% of the global market share.

The competition pattern of domestic machine vision industry is relatively scattered, and foreign enterprises occupy a larger market share and sales advantage in core parts. According to the panorama of Chinas machine vision industry, there are more than 200 international machine vision brands entering China, more than 100 local machine vision brands, more than 300 product agents and more than 100 system integrators. It can be seen that domestic machine vision enterprises are mainly product agents and system integrators, have less layout in the upstream field of the machine vision industry chain, and are not as strong as foreign established companies in the R & D capacity of machine vision core parts. Therefore, the medium and high-end market is mainly dominated by international first-line brands.

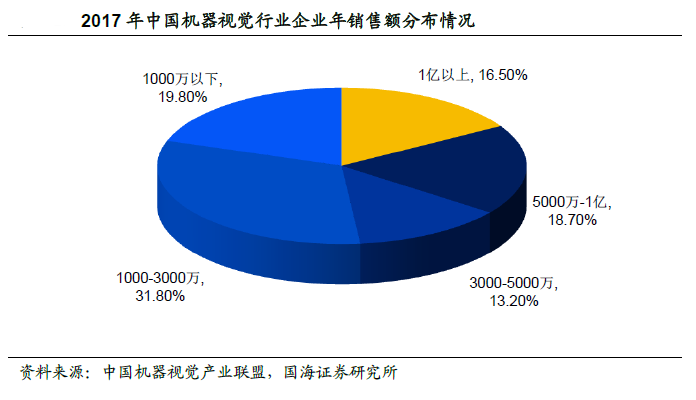

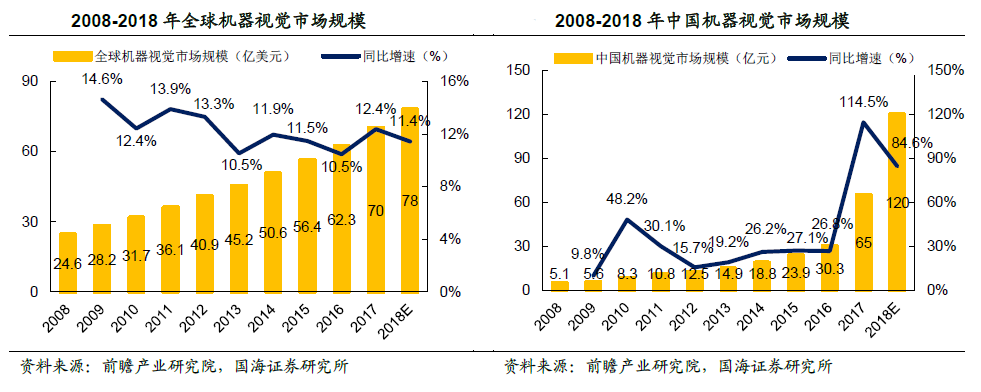

According to the enterprise survey results of China Machine Vision Industry Alliance in 2017, the sales of domestic machine vision enterprises account for the highest proportion of 10-30 million (31.8%), followed by less than 10 million (19.8%), 50-100 million (18.7%), more than 100 million (16.5%) and 30-50 million (13.2%). In 2017, Cognex achieved a revenue of 676 million yuan in Greater China. In contrast, most machine vision enterprises in China have a small sales scale.

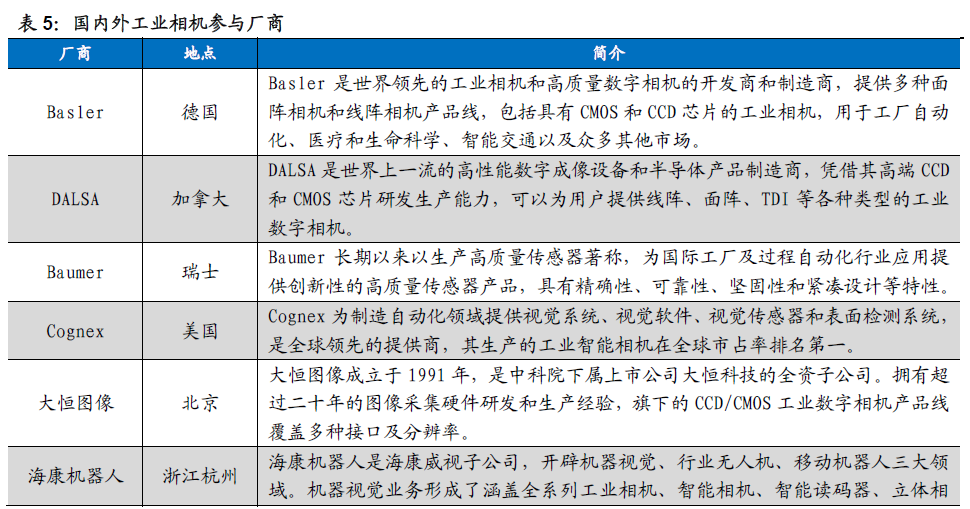

1. Industrial camera: the core component of capturing and analyzing objects

The premise of image analysis is that the optical signal is captured by the lens and transformed into orderly electrical signal. Different from civilian cameras, industrial cameras have higher image stability, transmission ability and anti-interference ability. They are the key components of machine vision system. At present, industrial camera products on the market mainly include wired array camera, area array camera, 3D camera and smart camera. Intelligent camera integrates the functions of image acquisition, processing and communication into a single camera, which has become the development trend of industrial camera.

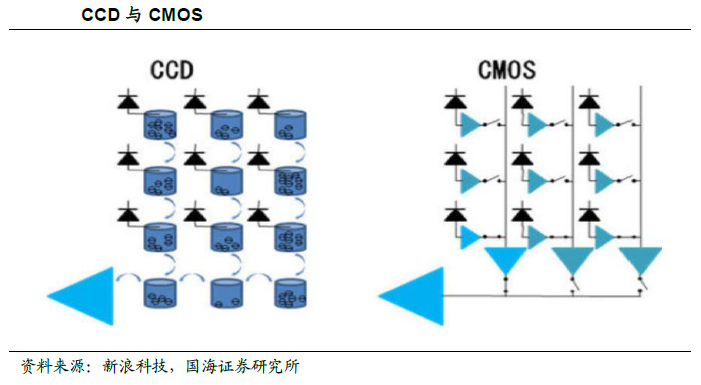

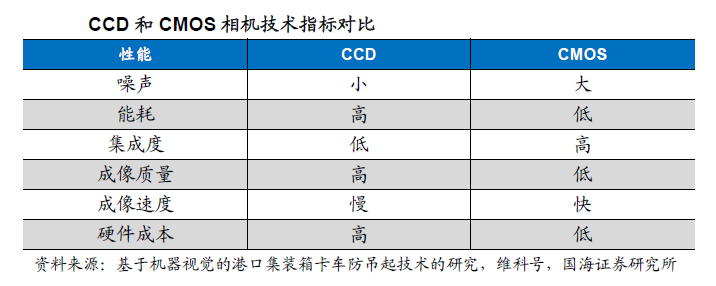

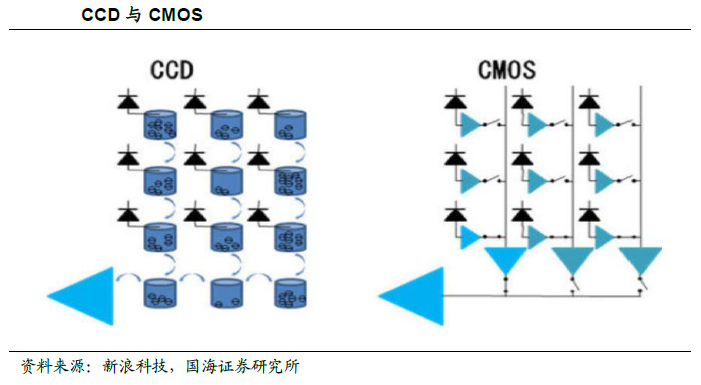

Image sensor is the core of camera. According to the chip type, it can be divided into CCD and CMOS image sensor. Both of them use photodiode for photoelectric conversion, but there are great differences in working principle and product characteristics.

CCD image sensor is a matrix composed of photodiode and storage area. After each photosensitive element converts light into charge, it is directly output to the storage unit of the next photosensitive element, and so on to the last photosensitive element to form a unified output, and then the amplifier amplifies the electrical signal and a special analog-to-digital conversion chip converts the analog signal into digital signal. Each photosensitive element in the CMOS sensor directly integrates the amplifier and analog-to-digital conversion logic (ADC). When the photosensitive diode receives light and generates an analog electrical signal, the electrical signal is first amplified by the amplifier in the photosensitive element, and then directly converted into the corresponding digital signal.

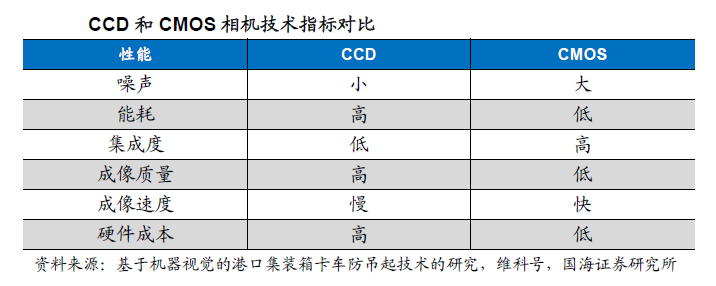

At the beginning of the application of CMOS sensor in machine vision, it is easy to overheat due to too frequent current changes when processing rapidly changing images, which makes it difficult to suppress the noise. Therefore, it is only used in medium and low-end industrial products with low image quality requirements; Because of the advantages of higher image quality and stronger anti noise ability, CCD is mostly used in high-end occasions.

With the extensive application of CMOS sensors in consumer electronic devices, the development of CMOS technology has been promoted, its performance has been significantly improved, and the manufacturing cost has been greatly reduced. The resolution and image quality of CMOS sensor are approaching that of CCD sensor. With the advantages of high speed (frame rate), high resolution (number of pixels), low power consumption and the latest improved noise index, quantum efficiency and color concept, CMOS sensor has established a stable market position and is gradually replacing CCD sensor in many fields of industrial image processing.

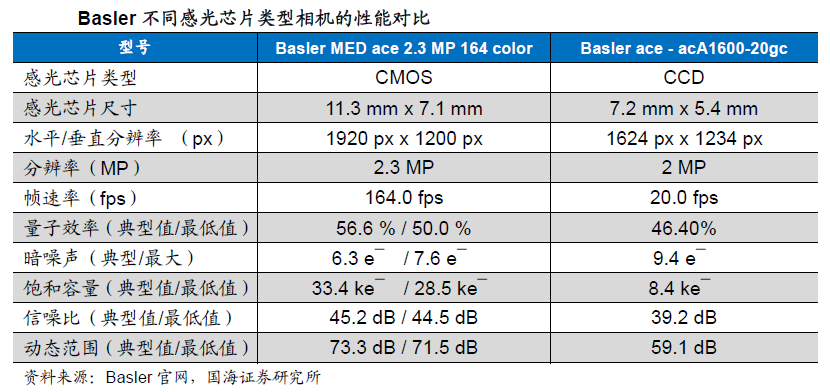

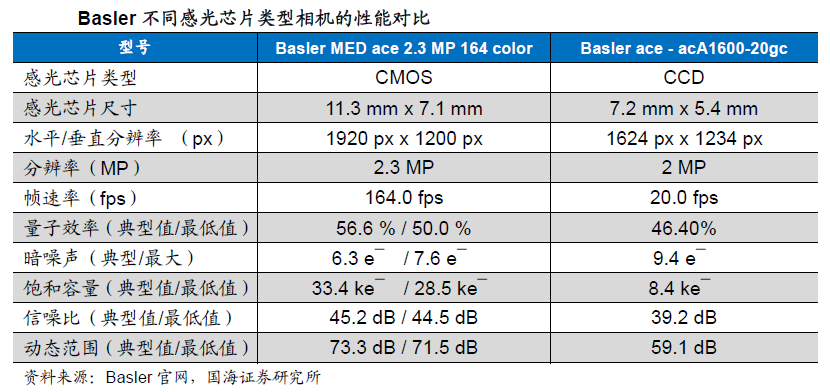

Taking Baslers industrial camera products as an example, under the condition of similar resolution, the frame rate of CMOS is significantly higher than that of CCD, and has higher quantum efficiency, signal-to-noise ratio, dynamic range and lower dark noise. It can be seen that CMOS has reached or better than CCD in some performance indexes, and has the ability to replace CCD.

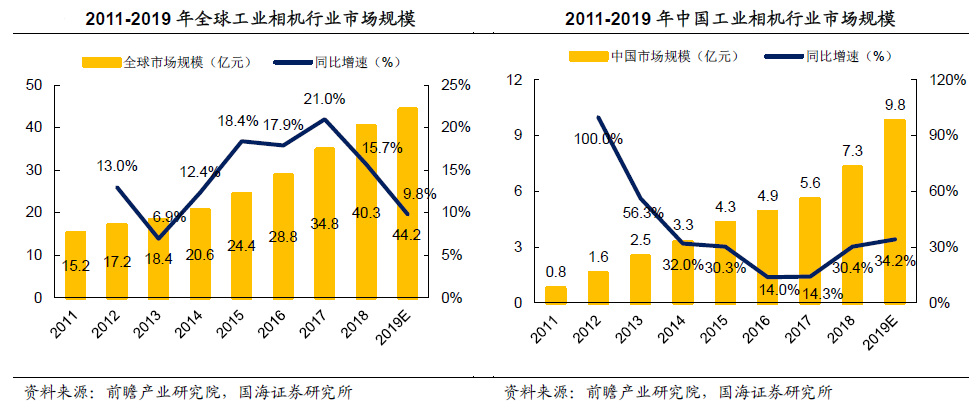

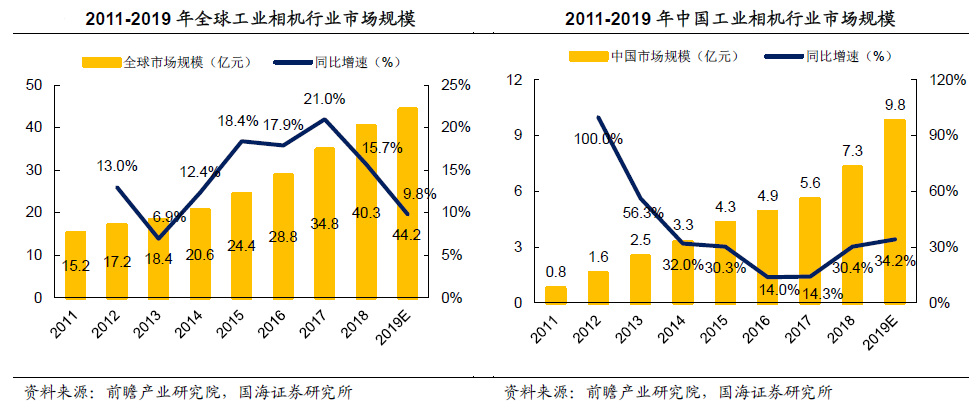

In recent years, the industrial camera industry has shown a rapid growth trend in both the global market and the Chinese market. The scale of the global industrial camera industry increased from 1.52 billion yuan in 2011 to 4.03 billion yuan in 2018, with an average annual compound growth rate of 14.95%; The scale of Chinas industrial camera industry was only 80 million yuan in 2011 and 730 million yuan in 2018, realizing 37A compound growth rate of 0.14%. Chinas industrial camera market is expanding rapidly at a growth rate far exceeding that of the global market.

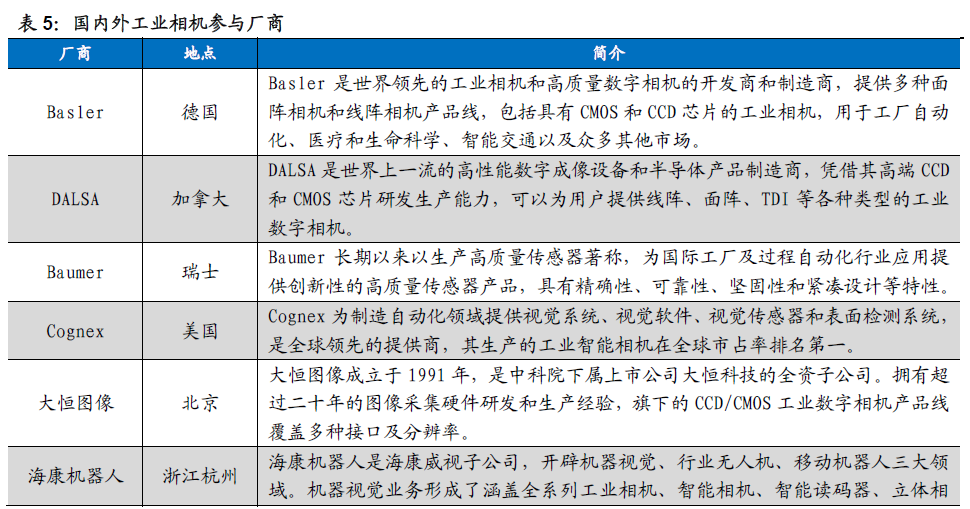

At present, the global industrial camera industry is dominated by European and American brands. According to the prospective industry research institute, in 2018, North American brands accounted for 62% of the global industrial camera market, while European brands accounted for 15%. Foreign well-known enterprises such as Basler in Germany, DALSA in Canada, konetsu in the United States, etc. From the perspective of segmentation, the industrial smart camera market presents a higher degree of concentration than the board camera market.

Chinas research on industrial cameras started late. At first, several old camera companies such as Daheng image acted as agents for foreign brands. In recent years, China has also gradually developed a number of domestic brands that independently develop industrial cameras, such as Daheng image, Haikang robot, Huarui technology and Weishi image. At present, Chinas industrial camera industry is mainly distributed in the middle and low-end market, which can gradually realize import substitution; In the field of high-resolution and high-speed high-end industrial cameras, it is still dominated by imported brands. According to the data of the General Administration of Customs of China, the number of industrial cameras imported in 2018 was 8159, with an import amount of US $44.83 million, a year-on-year increase of 8.3%.

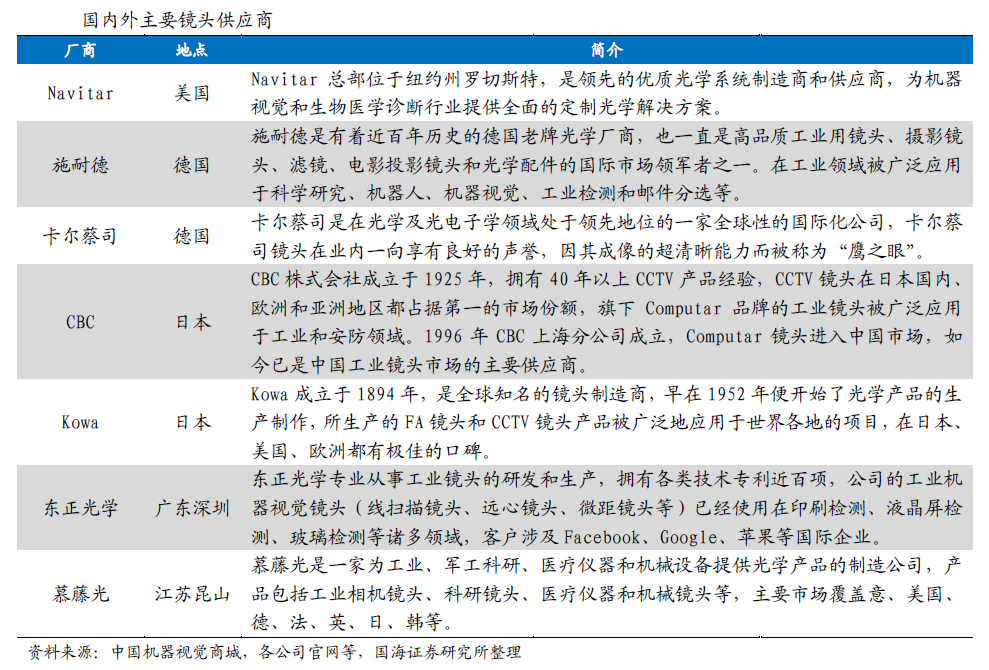

2. Lens: the core of clear imaging

The lens is an important imaging component in the image acquisition part of machine vision. The main function of the lens is to image the target on the photosensitive surface of the image sensor. The indexes such as resolution, contrast, depth of field and aberration have a key impact on the imaging quality.

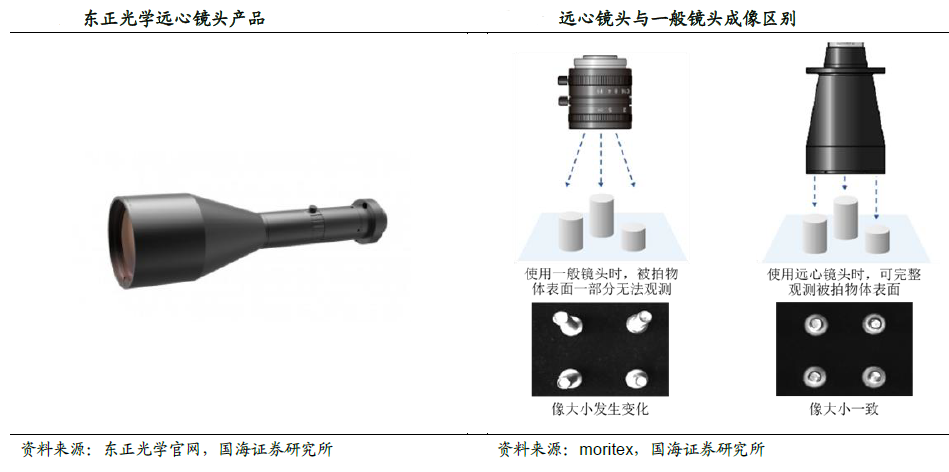

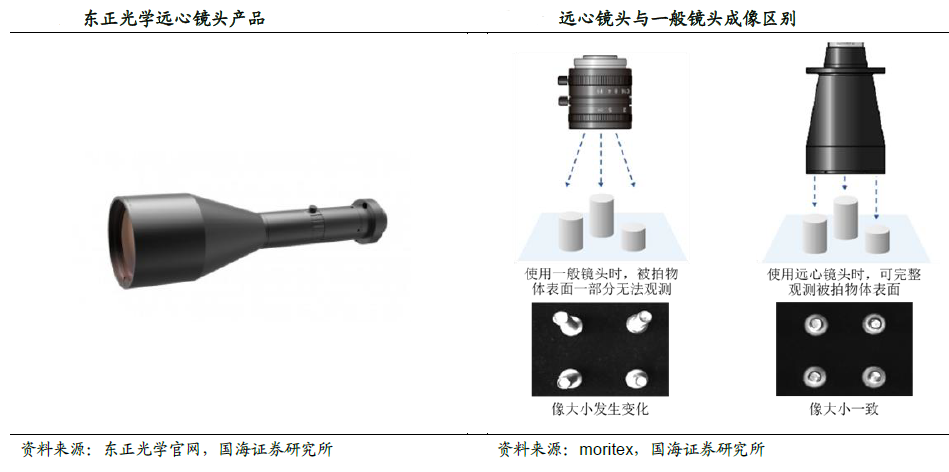

Industrial lens can be divided into fixed focus lens and zoom lens according to focal length; According to the aperture, it can be divided into fixed aperture and variable aperture; According to the field of view, it can be divided into telephoto lens, ordinary lens and wide-angle lens. In addition, there are several lenses with special purposes, such as telecentric lens, microscopic lens, macro lens, ultraviolet lens and infrared lens. Because the parallax of the traditional lens changes by 1 ~ 2% with the application of the lens, and the parallax is usually higher than that of the traditional lens. It can correct the influence of parallax within a certain object distance, and strictly control the distortion coefficient below 0.1%. Telecentric lens has been favored by machine vision applications with high requirements for lens distortion because of its unique parallel light path design, which meets the needs of precision detection.

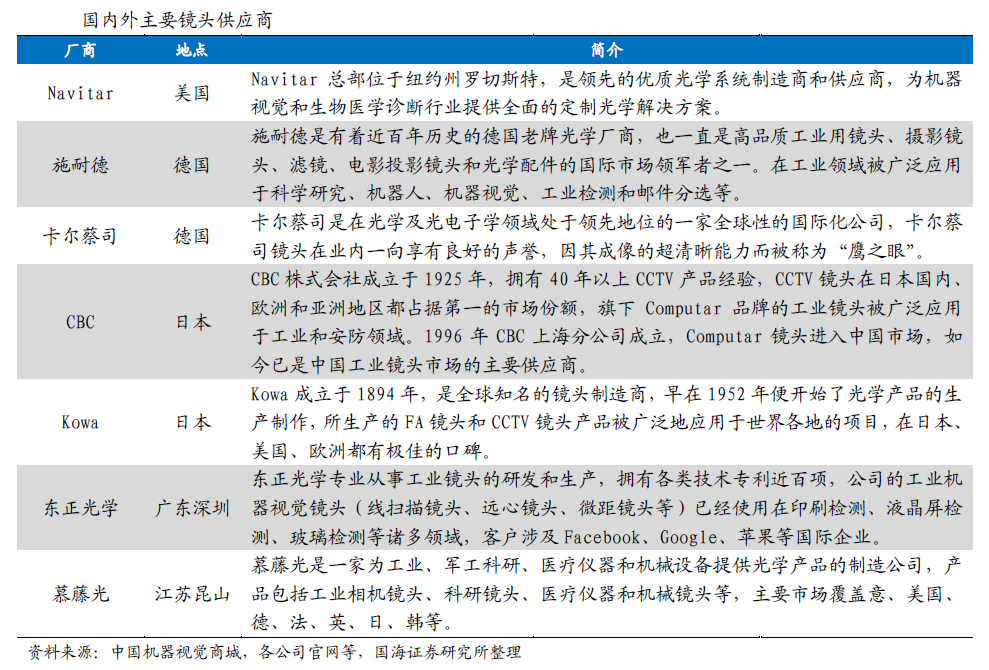

According to QYResearch, the total value of the global industrial lens market reached 3.3 billion yuan in 2019 and is expected to increase to 5.8 billion yuan in 2026, with an average annual compound growth rate of 8.3%. Overseas brands have invested early in the lens field. After years of business accumulation and technological upgrading, they have formed optical giants such as German Leica, Schneider, Carl Zeiss, Japanese CBC, Kowa, Nikon and Fuji all over the world. Because the optical lens industry integrates multi-disciplinary technologies such as precision mechanical design, geometric optics, thin film optics, colorimetry and thermodynamics, and the manufacturing process and process are complex, it has a high technical threshold.

Since China started late, the domestic optical lens market was basically monopolized by Japanese and German brands before 2008. In recent years, domestic manufacturers in Chinas industrial lens industry have grown rapidly, mainly from the middle and low-end market. With the advantage of high cost performance, they have a certain competitiveness for foreign brands. In the high-end market, China still mainly imports the products of old brand manufacturers such as Japan and Germany, but some enterprises such as Dongzheng optics and mutoguang are gradually moving towards high-end. The telecentric lens distortion of Dongzheng optics is less than 0.02%, and the magnification is complete. The macro lens products can also control the distortion at 0Under the ultra-low order of 0.1%.

3. Light source: design light path to realize target imaging

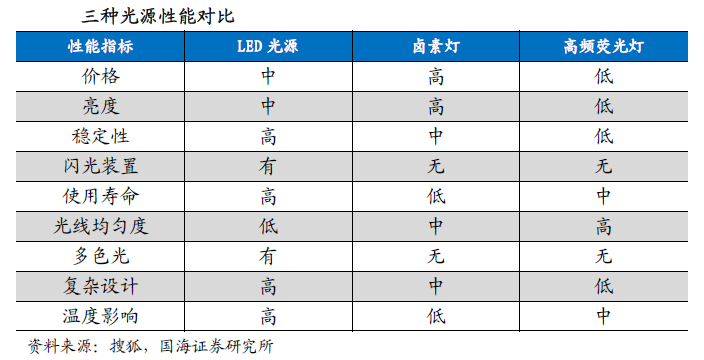

The light source has an important influence on the image acquisition part of machine vision, which lays a necessary foundation for subsequent image recognition and analysis. Appropriate light source equipment can distinguish the measured object from the background as much as possible, and obtain high-quality and high contrast images. In the application of machine vision, due to the different application objects and detection requirements, there is no general machine vision lighting system. It is necessary to design corresponding lighting schemes for specific cases to achieve the best lighting effect.

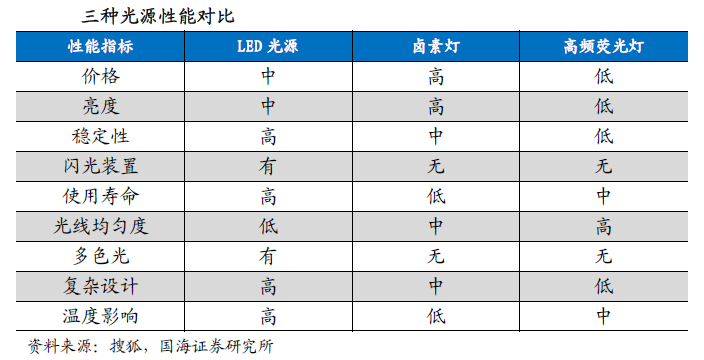

The light sources used in machine vision system are mainly divided into LED light source, halogen lamp and high-frequency fluorescent lamp, of which the most commonly used is led light source. LED light source is the light-emitting diode light source. Its light-emitting principle is different from that of incandescent lamp and gas discharge lamp. LED light source adopts solid semiconductor chip as light-emitting material, which has high energy conversion efficiency. Theoretically, it can achieve 10% energy consumption of incandescent lamp and 50% energy-saving effect compared with fluorescent lamp. In addition, LED light source has the characteristics of high shape freedom, long service life, fast response, good monochromaticity, various colors and high comprehensive cost performance. Therefore, it has a wider application in industrial fields such as machine vision.

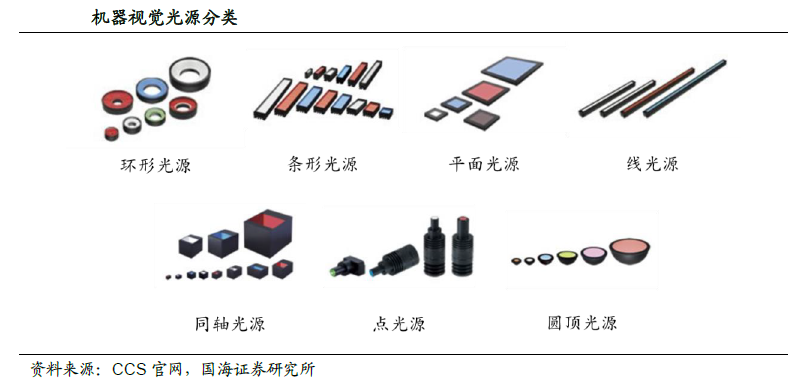

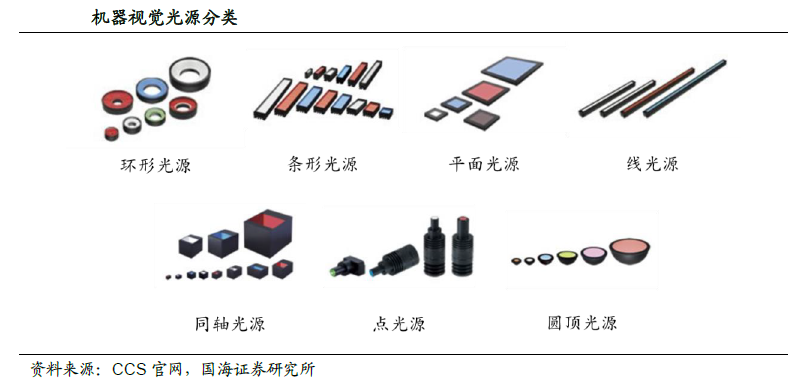

Machine vision light source products can be divided into many types according to shape, such as ring light source, strip light source, plane light source, line light source, point light source, coaxial light source, etc. Different shapes and structures can provide different brightness, intensity, illumination angle, illumination area and color combination, which are suitable for different machine vision application scenarios. For example, the annular light source is a conical LED array that irradiates the surface of the measured object at an oblique angle and illuminates a small area through diffuse reflection. When the working distance is 10-15mm, the annular light source can highlight the changes of the edge and height of the measured object. It is suitable for PCB substrate inspection, IC component inspection, integrated circuit printing inspection, etc.

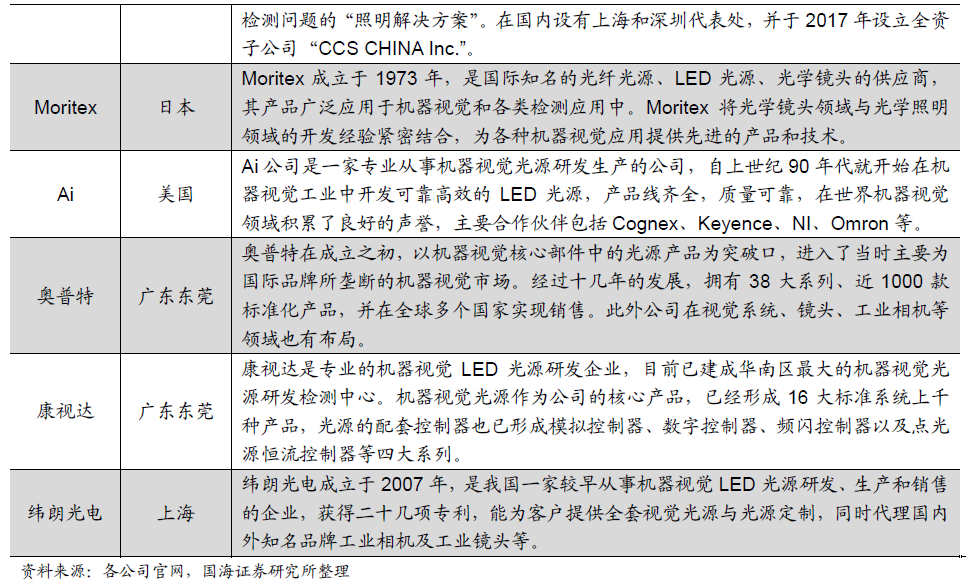

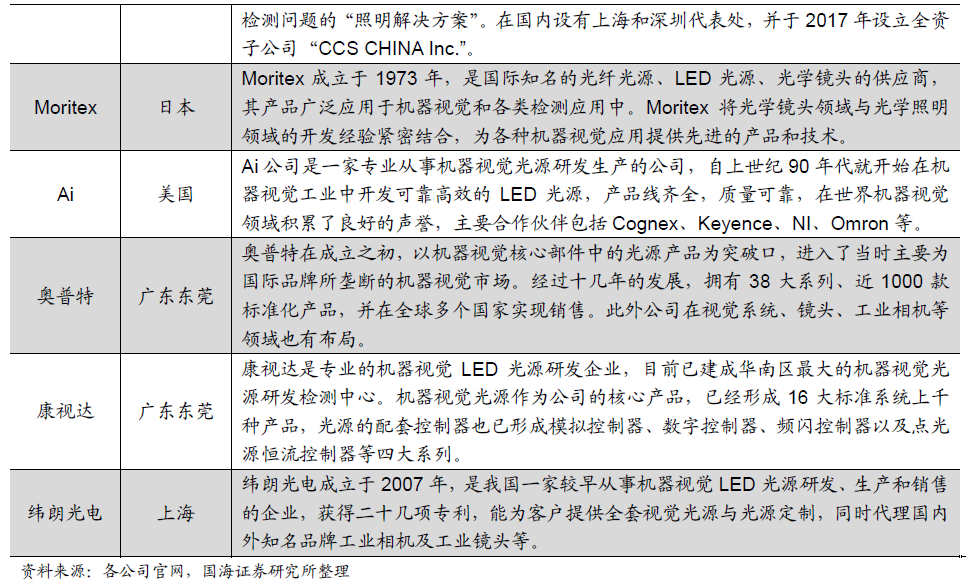

Foreign machine vision lighting technology has been relatively mature. The representative light source enterprises in the world mainly include Japanese CCS, moritex and American AI. The domestic light source market has a high degree of localization and full competition. A number of machine vision light source manufacturers such as aupt, wodep, CommScope and Weilang optoelectronics have emerged, which can compete with international brands.

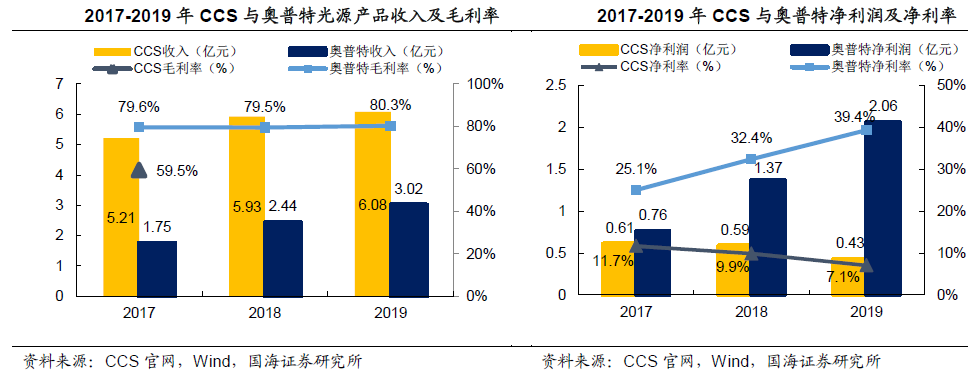

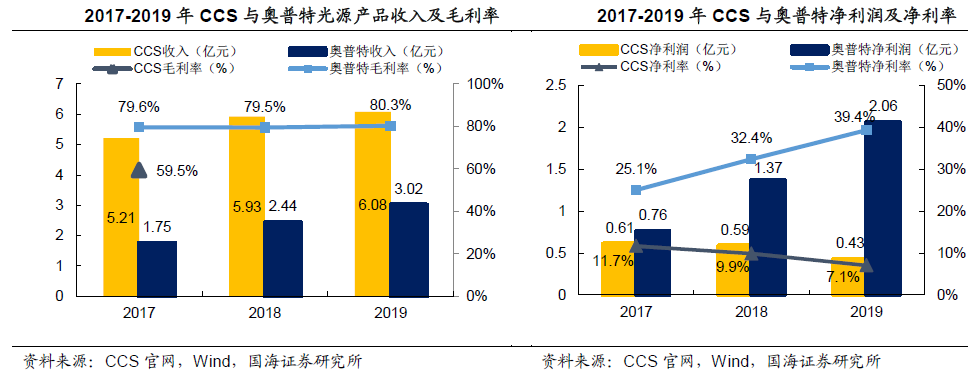

CCS has a high market share in the global light source market, and its main products are led light sources and controllers for image processing. According to the 2017 annual report of CCS, its operating revenue in 2017 reached 520 million yuan, of which light source and light source controller products accounted for 89.2% of the total revenue.

Aupt is a leading local brand in the domestic machine vision light source industry, which was established in 2006. Taking the light source as the starting point, aupt extends its products to other software and hardware products such as machine vision lens, camera, vision control system and so on. In 2019, the revenue of aupt light source and light source controller products was 300 million yuan. There is still a certain gap between the sales of aupt light source products and CCS, but its profitability is higher than CCS.

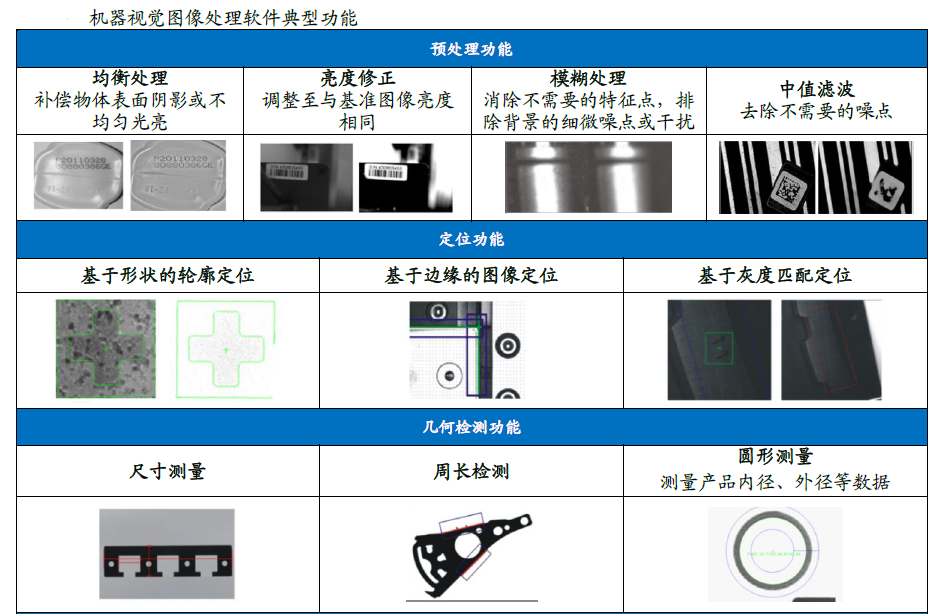

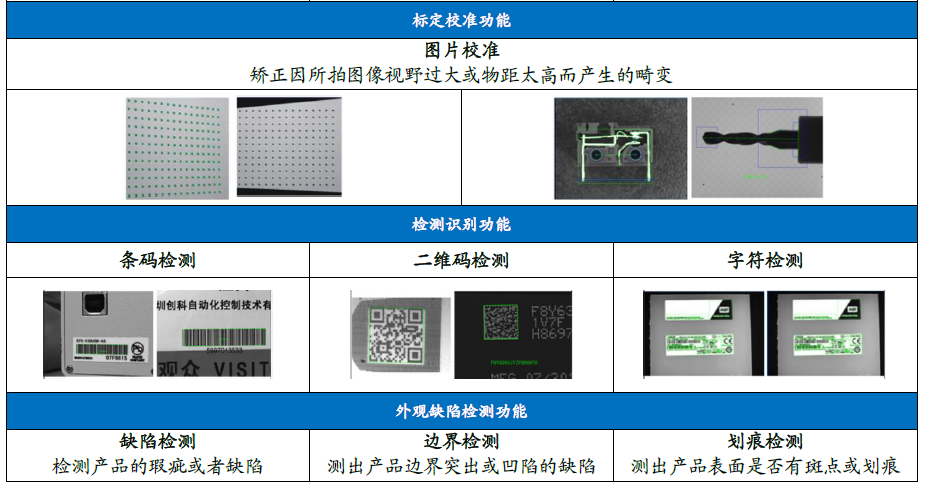

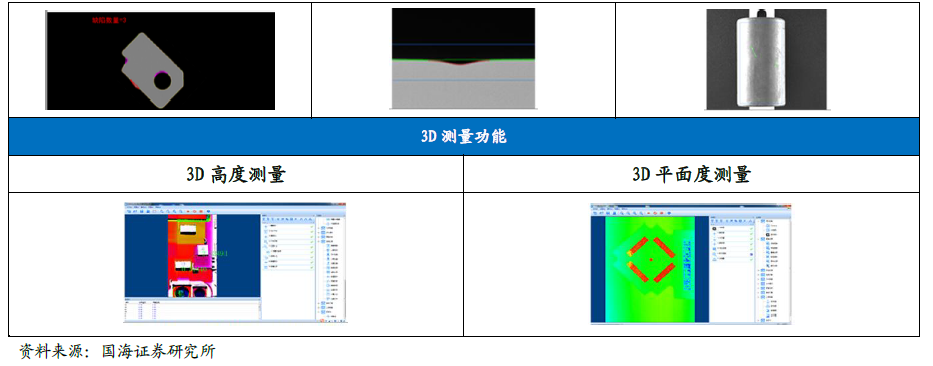

4. Image processing software: algorithms to achieve various goals

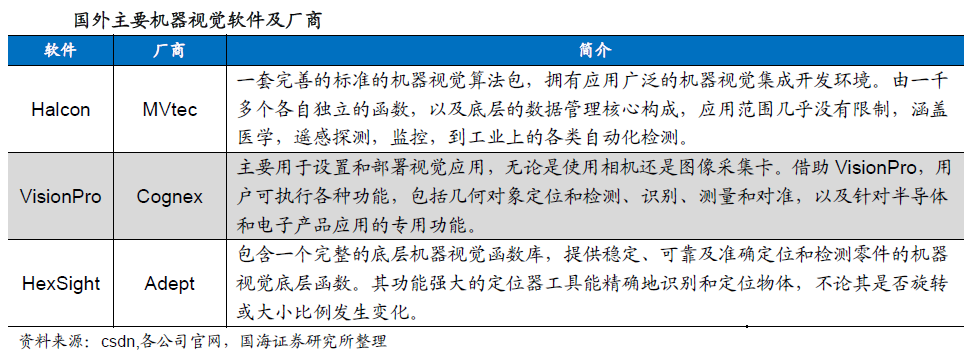

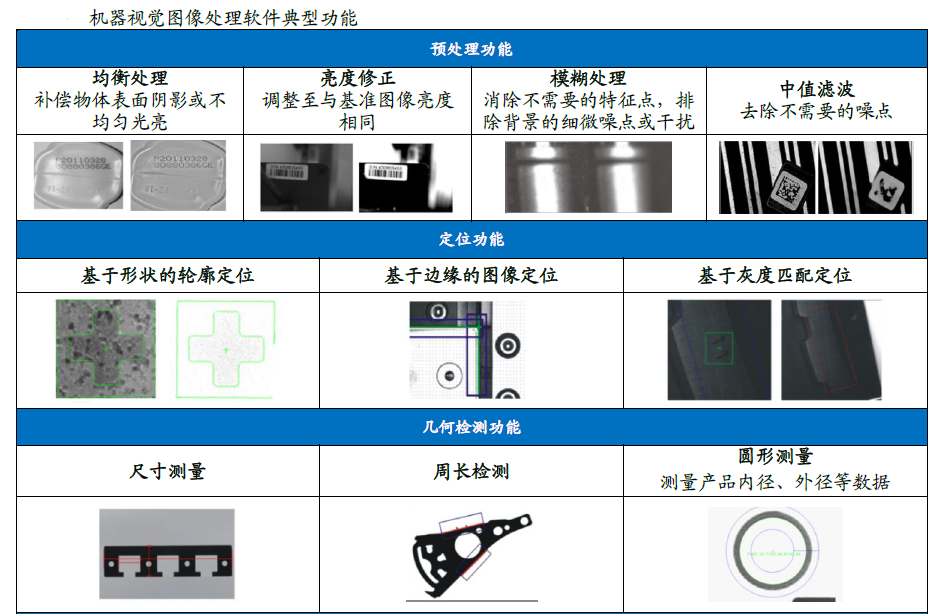

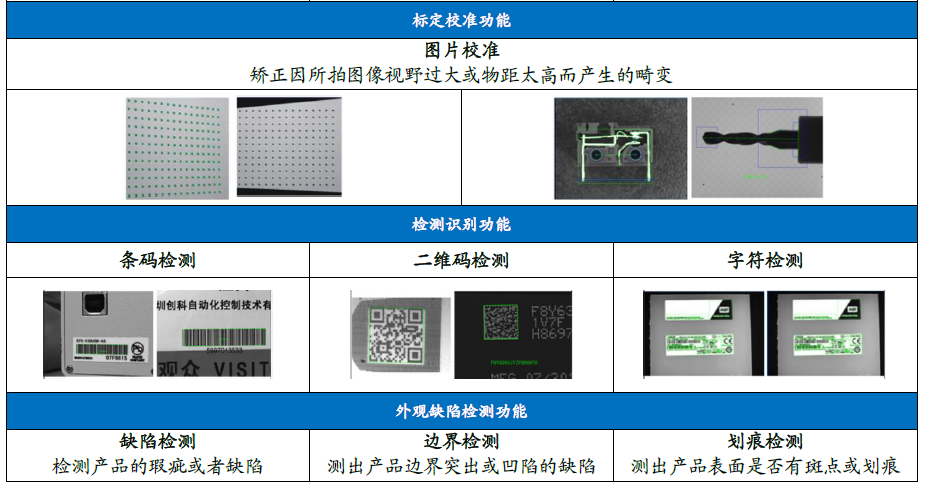

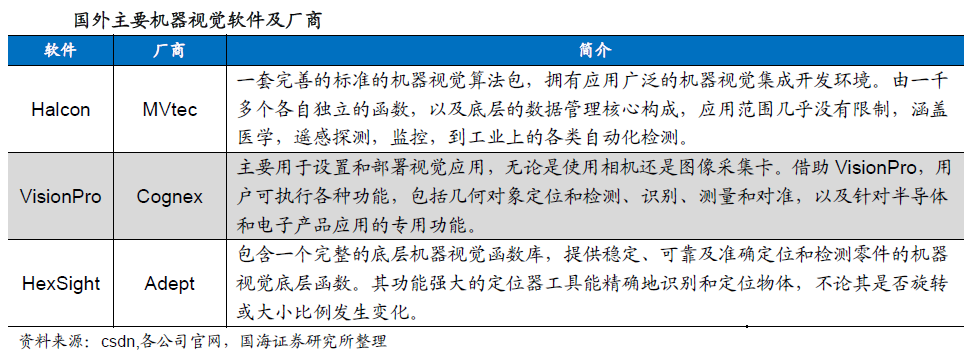

The key function of the machine is to obtain the visual signal of the measured object through the visual processing software. Machine vision software is mainly divided into two categories: one is a tool library containing a large number of processing algorithms, which is used to develop specific applications, and the main users are integrators and equipment manufacturers; The other is the application software that specially realizes some functions, which is mainly used by end users. The two are mainly different in the flexibility of development.

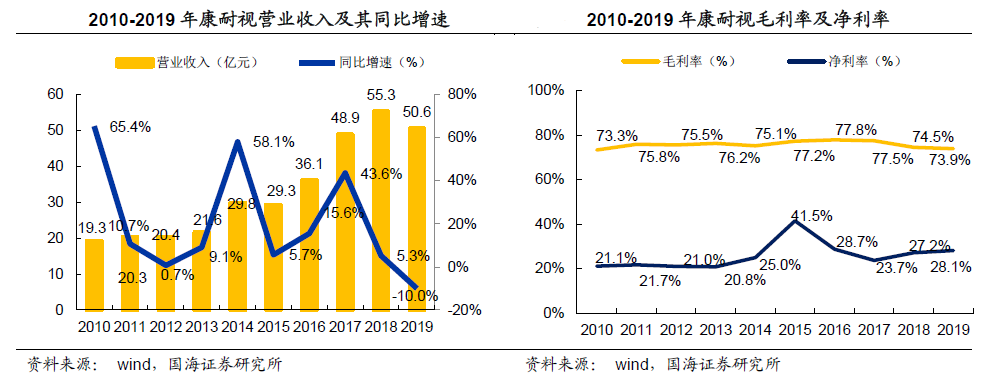

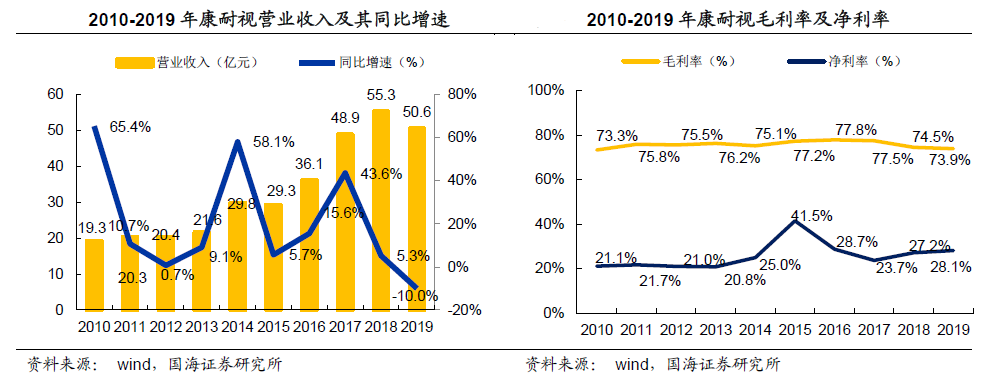

At present, the field of image processing software is mainly dominated by the United States, Germany and other countries. The main manufacturers include Cognex, MVtec, adept and so on. The underlying algorithms of the software are basically monopolized by the above manufacturers. Cognex, as one of the most representative manufacturers, has performed well in recent 10 years. The operating revenue of Kangshi increased from RMB 1.9 billion to RMB 2.5 billion.15%; The gross profit margin and net profit margin were basically stable, maintained at about 75% and 25% respectively.

Domestic machine vision image processing software generally carries out secondary development on the basis of open-source visual algorithm libraries such as opencv or third-party commercial algorithm libraries such as Halcon and visionpro. Due to the very high technical barriers of the independent underlying algorithm, only a few enterprises in China, such as Chuangke vision, Hikvision, opt, dimensional image and so on, have completed the research and application of the underlying algorithm in a certain range.

At present, visionbuilder is the most simple development platform of vision and image processing in the industry, including all the functions of visual code recognition and image reading. The system has high universality, which is embodied as follows: users are not required to have programming foundation, and it is suitable for all kinds of people; Applicable to 3C electronics, automobile manufacturing and other industries; Docking interfaces are reserved for different types of industrial cameras and PLC, which has good compatibility.

5. Representative enterprises in the field of machine vision

Tuyang Technology

Tuyang technology, located in Zhangjiang, Shanghai, is a technology company focusing on 3D machine vision technology. It provides customers with industrial vision solutions integrating hardware and algorithms: it collects real, accurate and effective information data (surrounding environment & amp; object size, location, etc.) through its "depth camera" product with unique technology, Then, with the help of computer hardware and software, the relevant images are measured, analyzed and output the results, so as to promote the gradual digitization of relevant industries from the source level.

Depth sensor DS 460

At present, Tuyang technology has provided products and services to hundreds of domestic enterprises, including abb, jd.com, xinbeiyang, Shunfeng, rookie and Korea post. It has obvious first mover advantages and high barriers in the cultivation of integrator ecosystem, scene polishing and technology accumulation.

Solomon

Solomon is committed to becoming a leading brand of 3D machine vision and industrial AI. Its products provide powerful functions of robots through advanced 3D vision and the latest in-depth learning technology, which can effectively solve tasks that robots cannot or are difficult to perform in the past. Solomons mission is to endow robots with "eyes" and "brain", so that they can have the ability of vision, recognition and judgment similar to human beings, and help customers improve productivity and quality and move towards advanced intelligent manufacturing through Solomons visual products and perfect services.

3D scanner

In 2019, it won the first vision systems designs 2019 innovators awards innovation award of the global Chinese enterprise. Solomon uses advanced in-depth learning technology to enable the robot to carry out pick-up and release tasks quickly and accurately, which can be widely used in many industries and bring users a new application experience.

OMRON

Omron Automation (China) Co., Ltd. is a multinational company leading industrial automation products and application of advanced technology. As part of Omrons global business, it has become a leader in the field of automation. With its unique "sensing and control" technology, Omron makes use of many years of experience and deep understanding of the production site to continuously meet customers pursuit of product diversification and high quality.

Vision sensor fq-m series

Elson

Elson intelligent technology provides users with professional robot 3D vision solutions and is committed to promoting the technology promotion and application of 3D vision technology in the global industrial field.

Fixed robot 3D vision system

Cognex

Kangnaishi visual inspection system (Shanghai) Co., Ltd. is an advanced provider of visual systems, visual software, visual sensors and industrial code readers for the field of manufacturing automation.

Vision system in sight 5600 / 5705

Kearns

With the rapid development of industrial automation, KEYENCE, as the main supplier of sensors and measuring instruments, is constantly developing and manufacturing newer and more reliable products to meet the needs of various manufacturing industries.

According to the prospective industry research institute, the global machine vision market grew from US $2.5 billion in 2008 to US $7 billion in 2017, with a compound annual growth rate of 12.3%. Chinas machine vision market has entered a stage of rapid development from 2008 to 2017, with a market scale of 6.5 billion yuan. The compound growth rate from 2008 to 2017 was 32.7%, significantly higher than the global level.

The high-end market of the international machine vision market is mainly occupied by American, German and Japanese brands. Cognex of the United States, National Instruments (Ni), Basler of Germany, Isra vision, KEYENCE of Japan and OMRON of Japan are international giants with technology accumulation and good customer reputation in the field of machine vision. As the two giants of the global machine vision industry, Cognex and Kearns monopolize nearly 50% of the global market share.

The competition pattern of domestic machine vision industry is relatively scattered, and foreign enterprises occupy a larger market share and sales advantage in core parts. According to the panorama of Chinas machine vision industry, there are more than 200 international machine vision brands entering China, more than 100 local machine vision brands, more than 300 product agents and more than 100 system integrators. It can be seen that domestic machine vision enterprises are mainly product agents and system integrators, have less layout in the upstream field of the machine vision industry chain, and are not as strong as foreign established companies in the R & D capacity of machine vision core parts. Therefore, the medium and high-end market is mainly dominated by international first-line brands.

According to the enterprise survey results of China Machine Vision Industry Alliance in 2017, the sales of domestic machine vision enterprises account for the highest proportion of 10-30 million (31.8%), followed by less than 10 million (19.8%), 50-100 million (18.7%), more than 100 million (16.5%) and 30-50 million (13.2%). In 2017, Cognex achieved a revenue of 676 million yuan in Greater China. In contrast, most machine vision enterprises in China have a small sales scale.

1. Industrial camera: the core component of capturing and analyzing objects

The premise of image analysis is that the optical signal is captured by the lens and transformed into orderly electrical signal. Different from civilian cameras, industrial cameras have higher image stability, transmission ability and anti-interference ability. They are the key components of machine vision system. At present, industrial camera products on the market mainly include wired array camera, area array camera, 3D camera and smart camera. Intelligent camera integrates the functions of image acquisition, processing and communication into a single camera, which has become the development trend of industrial camera.

Image sensor is the core of camera. According to the chip type, it can be divided into CCD and CMOS image sensor. Both of them use photodiode for photoelectric conversion, but there are great differences in working principle and product characteristics.

CCD image sensor is a matrix composed of photodiode and storage area. After each photosensitive element converts light into charge, it is directly output to the storage unit of the next photosensitive element, and so on to the last photosensitive element to form a unified output, and then the amplifier amplifies the electrical signal and a special analog-to-digital conversion chip converts the analog signal into digital signal. Each photosensitive element in the CMOS sensor directly integrates the amplifier and analog-to-digital conversion logic (ADC). When the photosensitive diode receives light and generates an analog electrical signal, the electrical signal is first amplified by the amplifier in the photosensitive element, and then directly converted into the corresponding digital signal.

At the beginning of the application of CMOS sensor in machine vision, it is easy to overheat due to too frequent current changes when processing rapidly changing images, which makes it difficult to suppress the noise. Therefore, it is only used in medium and low-end industrial products with low image quality requirements; Because of the advantages of higher image quality and stronger anti noise ability, CCD is mostly used in high-end occasions.

With the extensive application of CMOS sensors in consumer electronic devices, the development of CMOS technology has been promoted, its performance has been significantly improved, and the manufacturing cost has been greatly reduced. The resolution and image quality of CMOS sensor are approaching that of CCD sensor. With the advantages of high speed (frame rate), high resolution (number of pixels), low power consumption and the latest improved noise index, quantum efficiency and color concept, CMOS sensor has established a stable market position and is gradually replacing CCD sensor in many fields of industrial image processing.

Taking Baslers industrial camera products as an example, under the condition of similar resolution, the frame rate of CMOS is significantly higher than that of CCD, and has higher quantum efficiency, signal-to-noise ratio, dynamic range and lower dark noise. It can be seen that CMOS has reached or better than CCD in some performance indexes, and has the ability to replace CCD.

In recent years, the industrial camera industry has shown a rapid growth trend in both the global market and the Chinese market. The scale of the global industrial camera industry increased from 1.52 billion yuan in 2011 to 4.03 billion yuan in 2018, with an average annual compound growth rate of 14.95%; The scale of Chinas industrial camera industry was only 80 million yuan in 2011 and 730 million yuan in 2018, realizing 37A compound growth rate of 0.14%. Chinas industrial camera market is expanding rapidly at a growth rate far exceeding that of the global market.

At present, the global industrial camera industry is dominated by European and American brands. According to the prospective industry research institute, in 2018, North American brands accounted for 62% of the global industrial camera market, while European brands accounted for 15%. Foreign well-known enterprises such as Basler in Germany, DALSA in Canada, konetsu in the United States, etc. From the perspective of segmentation, the industrial smart camera market presents a higher degree of concentration than the board camera market.

Chinas research on industrial cameras started late. At first, several old camera companies such as Daheng image acted as agents for foreign brands. In recent years, China has also gradually developed a number of domestic brands that independently develop industrial cameras, such as Daheng image, Haikang robot, Huarui technology and Weishi image. At present, Chinas industrial camera industry is mainly distributed in the middle and low-end market, which can gradually realize import substitution; In the field of high-resolution and high-speed high-end industrial cameras, it is still dominated by imported brands. According to the data of the General Administration of Customs of China, the number of industrial cameras imported in 2018 was 8159, with an import amount of US $44.83 million, a year-on-year increase of 8.3%.

2. Lens: the core of clear imaging

The lens is an important imaging component in the image acquisition part of machine vision. The main function of the lens is to image the target on the photosensitive surface of the image sensor. The indexes such as resolution, contrast, depth of field and aberration have a key impact on the imaging quality.

Industrial lens can be divided into fixed focus lens and zoom lens according to focal length; According to the aperture, it can be divided into fixed aperture and variable aperture; According to the field of view, it can be divided into telephoto lens, ordinary lens and wide-angle lens. In addition, there are several lenses with special purposes, such as telecentric lens, microscopic lens, macro lens, ultraviolet lens and infrared lens. Because the parallax of the traditional lens changes by 1 ~ 2% with the application of the lens, and the parallax is usually higher than that of the traditional lens. It can correct the influence of parallax within a certain object distance, and strictly control the distortion coefficient below 0.1%. Telecentric lens has been favored by machine vision applications with high requirements for lens distortion because of its unique parallel light path design, which meets the needs of precision detection.

According to QYResearch, the total value of the global industrial lens market reached 3.3 billion yuan in 2019 and is expected to increase to 5.8 billion yuan in 2026, with an average annual compound growth rate of 8.3%. Overseas brands have invested early in the lens field. After years of business accumulation and technological upgrading, they have formed optical giants such as German Leica, Schneider, Carl Zeiss, Japanese CBC, Kowa, Nikon and Fuji all over the world. Because the optical lens industry integrates multi-disciplinary technologies such as precision mechanical design, geometric optics, thin film optics, colorimetry and thermodynamics, and the manufacturing process and process are complex, it has a high technical threshold.

Since China started late, the domestic optical lens market was basically monopolized by Japanese and German brands before 2008. In recent years, domestic manufacturers in Chinas industrial lens industry have grown rapidly, mainly from the middle and low-end market. With the advantage of high cost performance, they have a certain competitiveness for foreign brands. In the high-end market, China still mainly imports the products of old brand manufacturers such as Japan and Germany, but some enterprises such as Dongzheng optics and mutoguang are gradually moving towards high-end. The telecentric lens distortion of Dongzheng optics is less than 0.02%, and the magnification is complete. The macro lens products can also control the distortion at 0Under the ultra-low order of 0.1%.

3. Light source: design light path to realize target imaging

The light source has an important influence on the image acquisition part of machine vision, which lays a necessary foundation for subsequent image recognition and analysis. Appropriate light source equipment can distinguish the measured object from the background as much as possible, and obtain high-quality and high contrast images. In the application of machine vision, due to the different application objects and detection requirements, there is no general machine vision lighting system. It is necessary to design corresponding lighting schemes for specific cases to achieve the best lighting effect.

The light sources used in machine vision system are mainly divided into LED light source, halogen lamp and high-frequency fluorescent lamp, of which the most commonly used is led light source. LED light source is the light-emitting diode light source. Its light-emitting principle is different from that of incandescent lamp and gas discharge lamp. LED light source adopts solid semiconductor chip as light-emitting material, which has high energy conversion efficiency. Theoretically, it can achieve 10% energy consumption of incandescent lamp and 50% energy-saving effect compared with fluorescent lamp. In addition, LED light source has the characteristics of high shape freedom, long service life, fast response, good monochromaticity, various colors and high comprehensive cost performance. Therefore, it has a wider application in industrial fields such as machine vision.

Machine vision light source products can be divided into many types according to shape, such as ring light source, strip light source, plane light source, line light source, point light source, coaxial light source, etc. Different shapes and structures can provide different brightness, intensity, illumination angle, illumination area and color combination, which are suitable for different machine vision application scenarios. For example, the annular light source is a conical LED array that irradiates the surface of the measured object at an oblique angle and illuminates a small area through diffuse reflection. When the working distance is 10-15mm, the annular light source can highlight the changes of the edge and height of the measured object. It is suitable for PCB substrate inspection, IC component inspection, integrated circuit printing inspection, etc.

Foreign machine vision lighting technology has been relatively mature. The representative light source enterprises in the world mainly include Japanese CCS, moritex and American AI. The domestic light source market has a high degree of localization and full competition. A number of machine vision light source manufacturers such as aupt, wodep, CommScope and Weilang optoelectronics have emerged, which can compete with international brands.

CCS has a high market share in the global light source market, and its main products are led light sources and controllers for image processing. According to the 2017 annual report of CCS, its operating revenue in 2017 reached 520 million yuan, of which light source and light source controller products accounted for 89.2% of the total revenue.

Aupt is a leading local brand in the domestic machine vision light source industry, which was established in 2006. Taking the light source as the starting point, aupt extends its products to other software and hardware products such as machine vision lens, camera, vision control system and so on. In 2019, the revenue of aupt light source and light source controller products was 300 million yuan. There is still a certain gap between the sales of aupt light source products and CCS, but its profitability is higher than CCS.

4. Image processing software: algorithms to achieve various goals

The key function of the machine is to obtain the visual signal of the measured object through the visual processing software. Machine vision software is mainly divided into two categories: one is a tool library containing a large number of processing algorithms, which is used to develop specific applications, and the main users are integrators and equipment manufacturers; The other is the application software that specially realizes some functions, which is mainly used by end users. The two are mainly different in the flexibility of development.

At present, the field of image processing software is mainly dominated by the United States, Germany and other countries. The main manufacturers include Cognex, MVtec, adept and so on. The underlying algorithms of the software are basically monopolized by the above manufacturers. Cognex, as one of the most representative manufacturers, has performed well in recent 10 years. The operating revenue of Kangshi increased from RMB 1.9 billion to RMB 2.5 billion.15%; The gross profit margin and net profit margin were basically stable, maintained at about 75% and 25% respectively.

Domestic machine vision image processing software generally carries out secondary development on the basis of open-source visual algorithm libraries such as opencv or third-party commercial algorithm libraries such as Halcon and visionpro. Due to the very high technical barriers of the independent underlying algorithm, only a few enterprises in China, such as Chuangke vision, Hikvision, opt, dimensional image and so on, have completed the research and application of the underlying algorithm in a certain range.

At present, visionbuilder is the most simple development platform of vision and image processing in the industry, including all the functions of visual code recognition and image reading. The system has high universality, which is embodied as follows: users are not required to have programming foundation, and it is suitable for all kinds of people; Applicable to 3C electronics, automobile manufacturing and other industries; Docking interfaces are reserved for different types of industrial cameras and PLC, which has good compatibility.

5. Representative enterprises in the field of machine vision

Tuyang Technology

Tuyang technology, located in Zhangjiang, Shanghai, is a technology company focusing on 3D machine vision technology. It provides customers with industrial vision solutions integrating hardware and algorithms: it collects real, accurate and effective information data (surrounding environment & amp; object size, location, etc.) through its "depth camera" product with unique technology, Then, with the help of computer hardware and software, the relevant images are measured, analyzed and output the results, so as to promote the gradual digitization of relevant industries from the source level.

Depth sensor DS 460

At present, Tuyang technology has provided products and services to hundreds of domestic enterprises, including abb, jd.com, xinbeiyang, Shunfeng, rookie and Korea post. It has obvious first mover advantages and high barriers in the cultivation of integrator ecosystem, scene polishing and technology accumulation.

Solomon

Solomon is committed to becoming a leading brand of 3D machine vision and industrial AI. Its products provide powerful functions of robots through advanced 3D vision and the latest in-depth learning technology, which can effectively solve tasks that robots cannot or are difficult to perform in the past. Solomons mission is to endow robots with "eyes" and "brain", so that they can have the ability of vision, recognition and judgment similar to human beings, and help customers improve productivity and quality and move towards advanced intelligent manufacturing through Solomons visual products and perfect services.

3D scanner

In 2019, it won the first vision systems designs 2019 innovators awards innovation award of the global Chinese enterprise. Solomon uses advanced in-depth learning technology to enable the robot to carry out pick-up and release tasks quickly and accurately, which can be widely used in many industries and bring users a new application experience.

OMRON

Omron Automation (China) Co., Ltd. is a multinational company leading industrial automation products and application of advanced technology. As part of Omrons global business, it has become a leader in the field of automation. With its unique "sensing and control" technology, Omron makes use of many years of experience and deep understanding of the production site to continuously meet customers pursuit of product diversification and high quality.

Vision sensor fq-m series

Elson

Elson intelligent technology provides users with professional robot 3D vision solutions and is committed to promoting the technology promotion and application of 3D vision technology in the global industrial field.

Fixed robot 3D vision system

Cognex

Kangnaishi visual inspection system (Shanghai) Co., Ltd. is an advanced provider of visual systems, visual software, visual sensors and industrial code readers for the field of manufacturing automation.

Vision system in sight 5600 / 5705

Kearns

With the rapid development of industrial automation, KEYENCE, as the main supplier of sensors and measuring instruments, is constantly developing and manufacturing newer and more reliable products to meet the needs of various manufacturing industries.